More business. Less risk.

As uncertainty and volatility spread across ferrous markets, you may ensure costs, revenues, and margins while growing business sustainably.

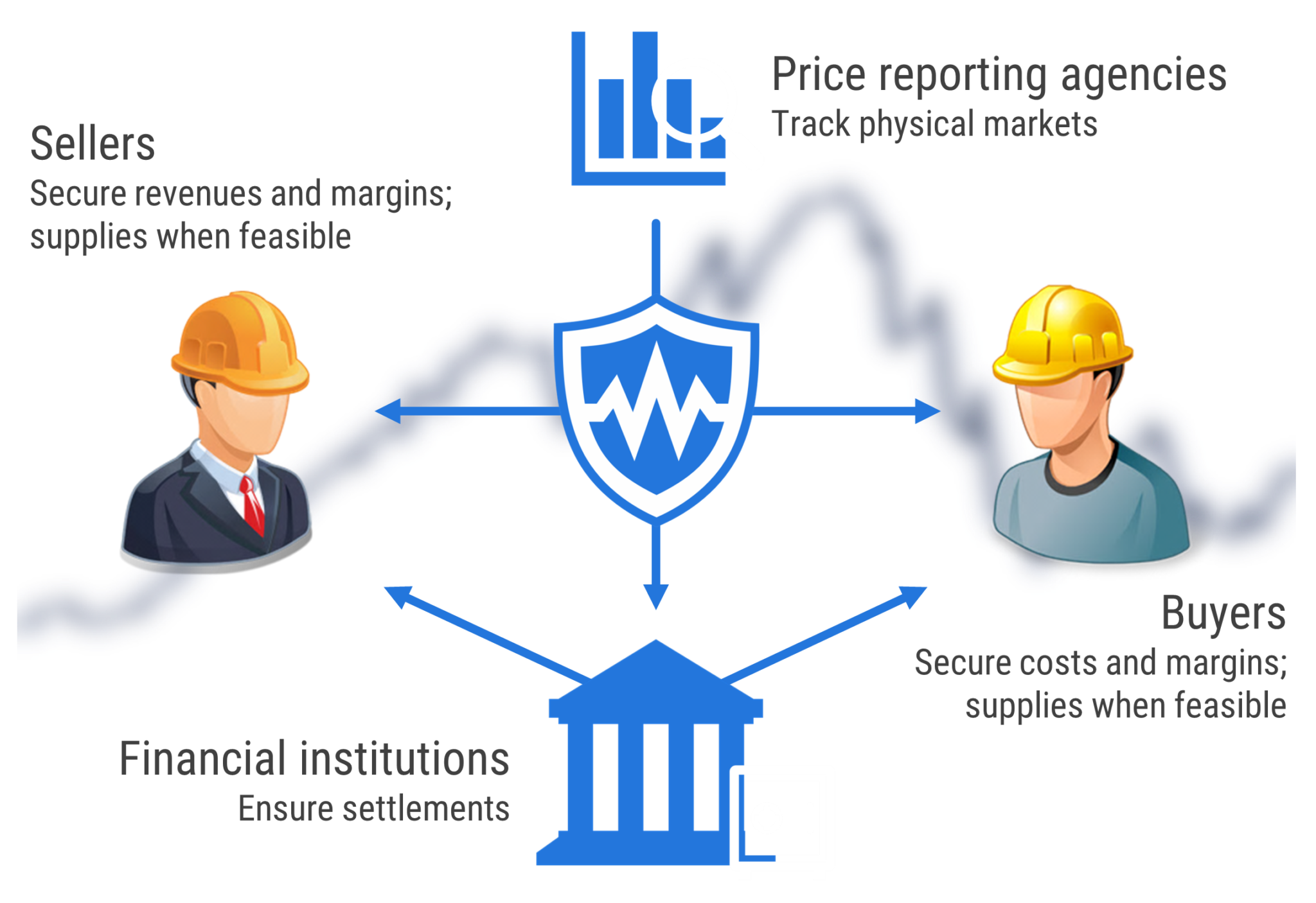

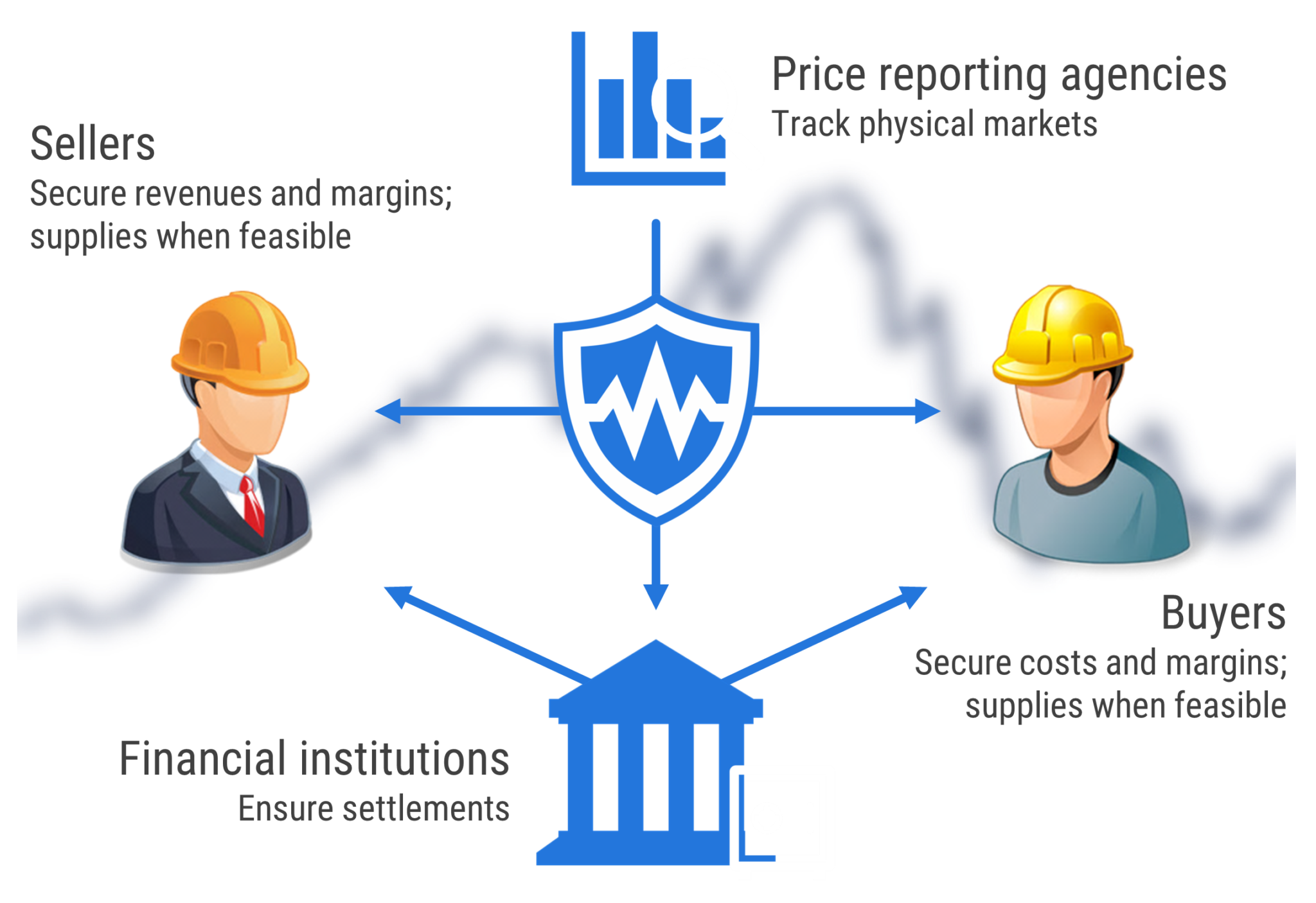

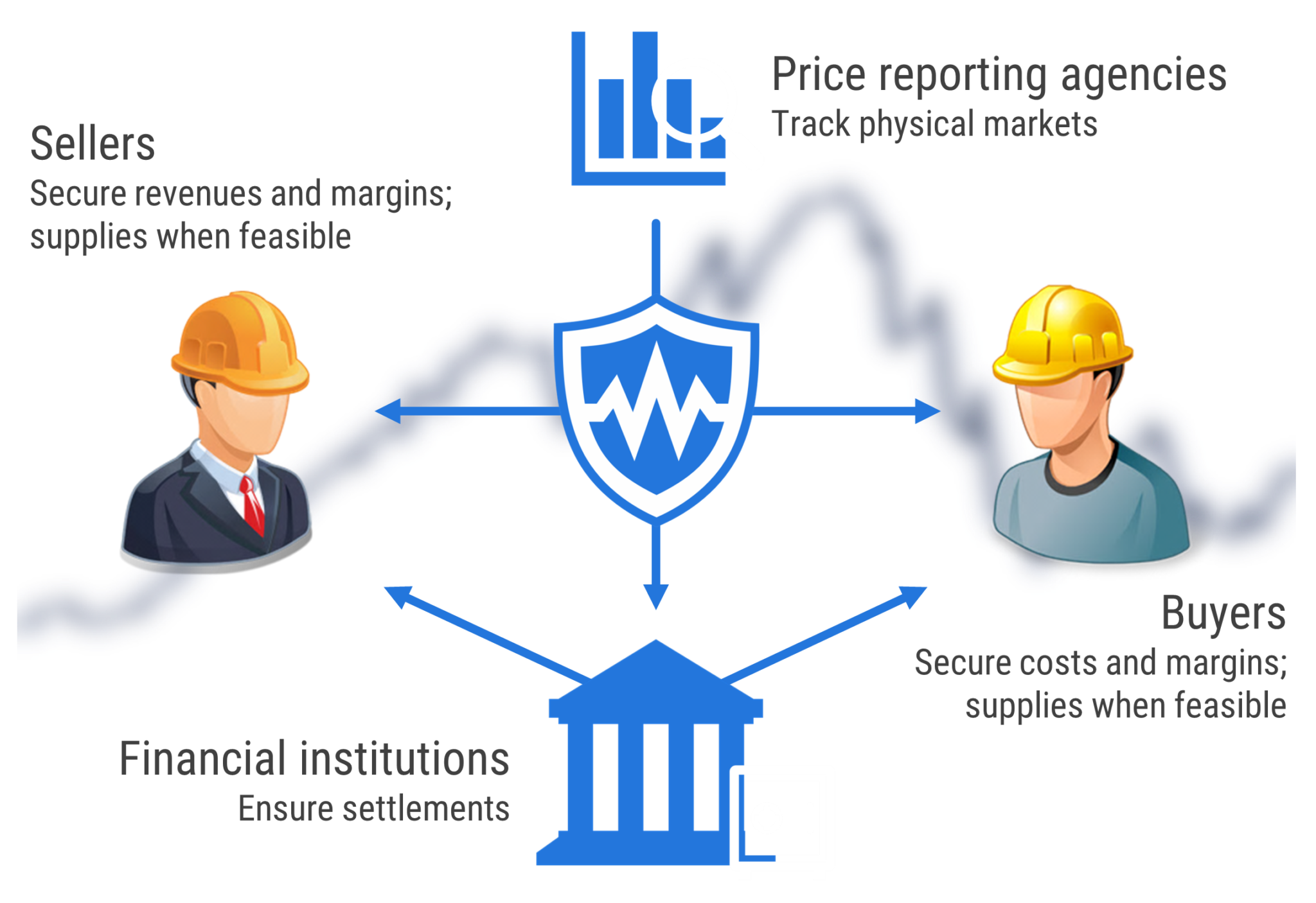

SteelHedge is a forward trading platform for steel and steelmaking raw materials, making it Direct, Simple, and Safe.

More business. Less risk.

As uncertainty and volatility spread across ferrous markets, you may ensure costs, revenues, and margins while growing business sustainably.

SteelHedge is a forward trading platform for steel and steelmaking raw materials, making it Direct, Simple, and Safe.

Direct

No middlemen

Bilateral transactions involve counterparties of your choosing that comply with criteria you define.

Now you may be in full control of S&O planning at low or no cost.

Simple

No derivatives

A modular contract tracks dozens products in many currencies throughout your supply chain.

Now you may reduce complexity to concentrate on core business.

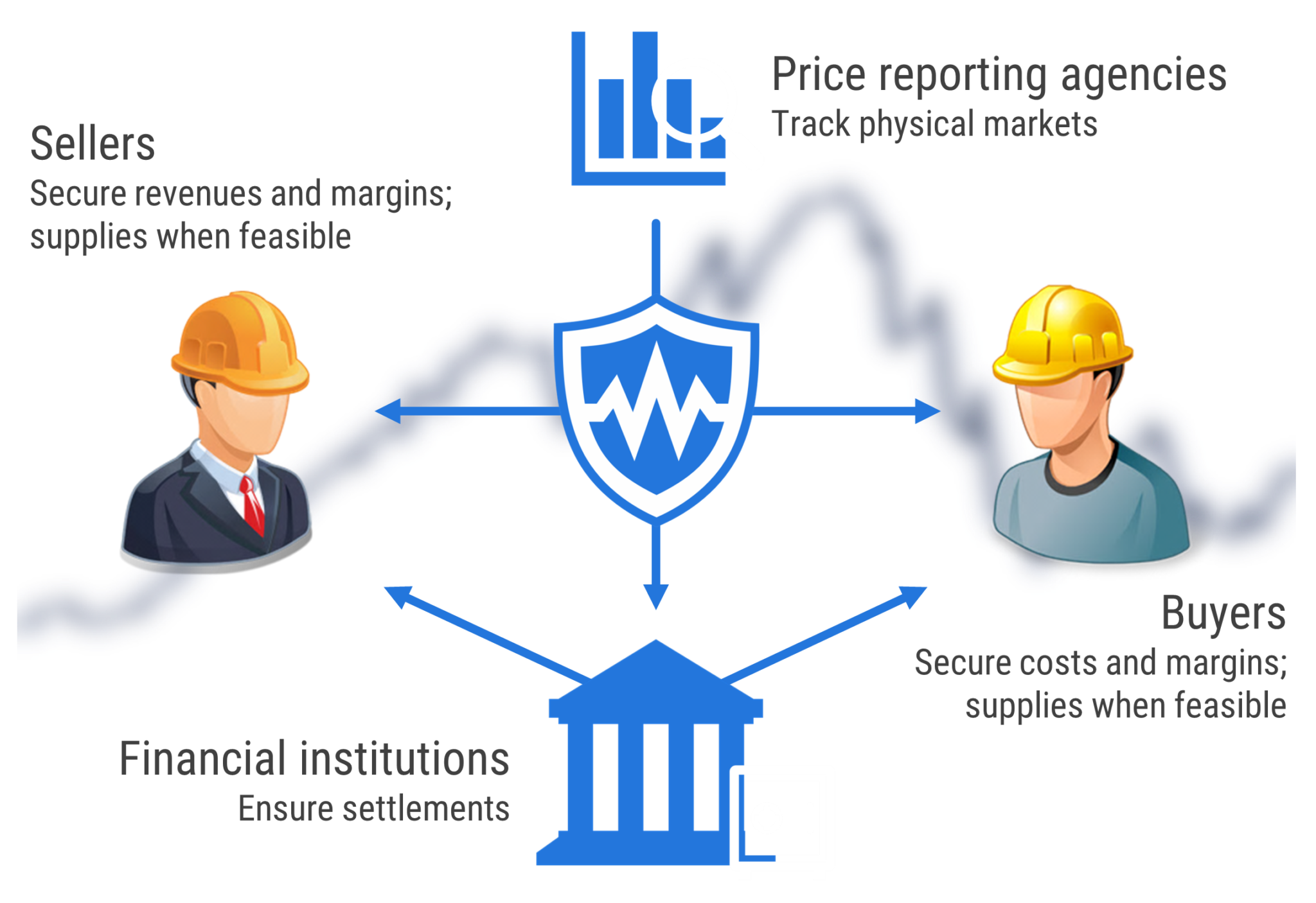

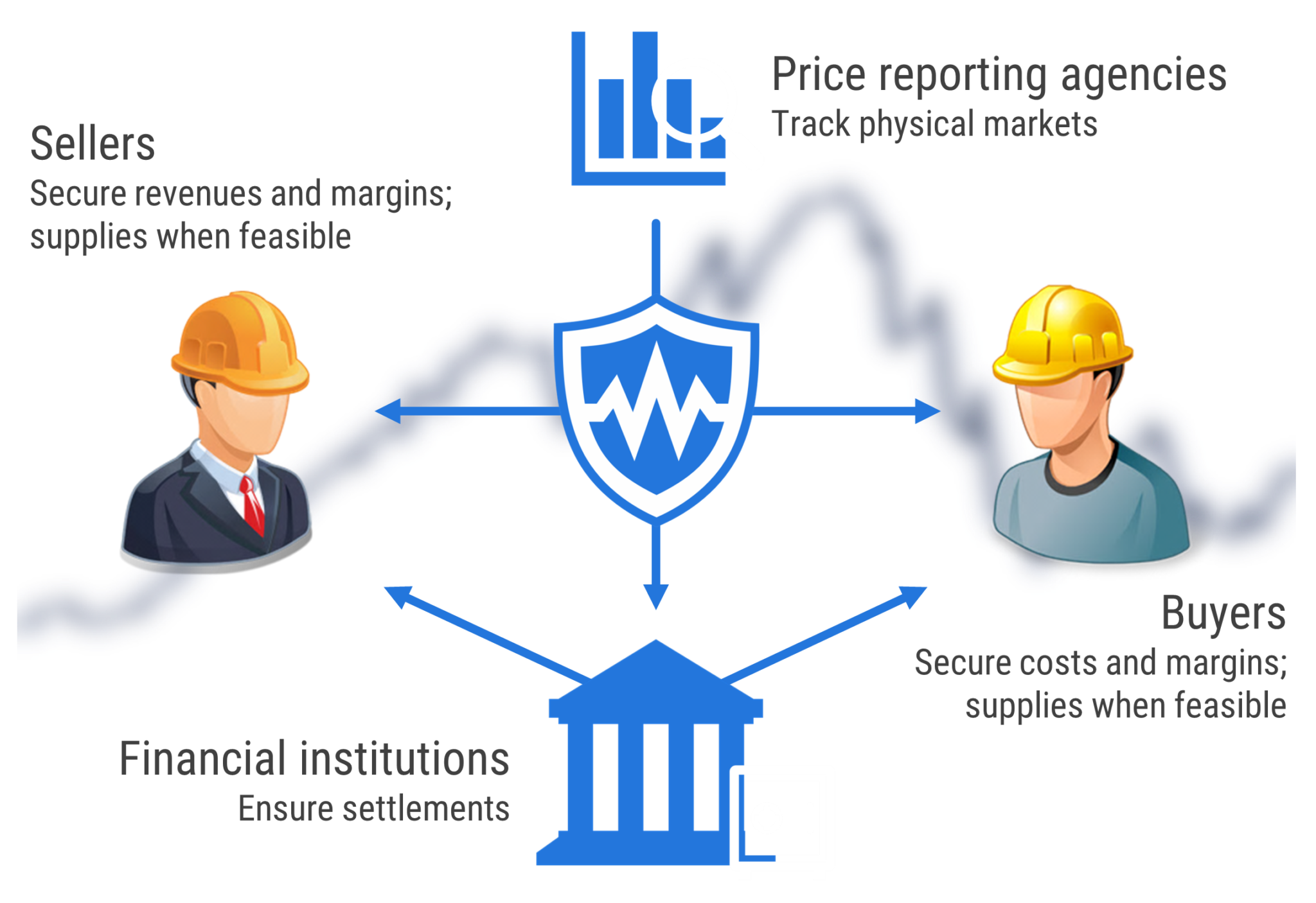

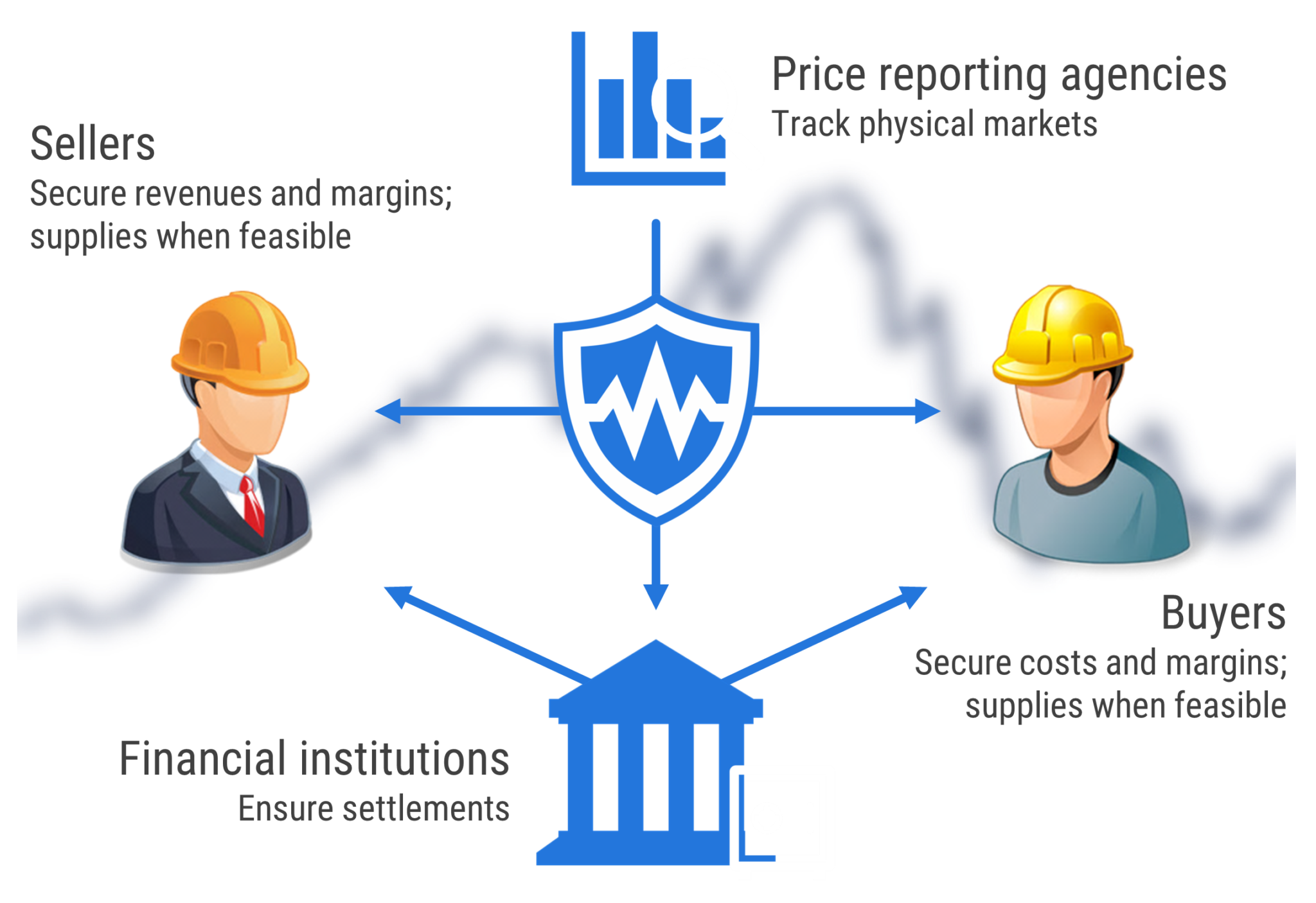

Safe

No credit risk

When required, leading financial institutions ensure contractual settlements in any market situation.

Now you may choose several post-trade processing options.

Direct

No middlemen

Each hedging transaction is with a real economy counterparty of your choosing that complies with criteria that you define.

Now you may be in full control of price risk management, from anywhere, round the clock.

Simple

No derivatives

A flexible paper contract that highly correlates and easily integrates with your supply agreements.

Now you may speak the same language with all stakeholders and explain hedging to a kid.

Safe

No credit risk

When required, leading financial institutions ensure that your paper contracts are honored in any market situation.

Now you may choose among several post-trade processing options for each transaction.

Modular Contract

Settlement Options

Currencies

Pricing References

All steel grades and raw materials in one place

Modular Contract

Settlement Options

Currencies

Pricing References

All steel grades and raw materials in one place

A Digital Solution for Sustainable Economy

A Digital Solution for Sustainable Economy

Outcomes

Financial

Earnings volatility Down

Cost of finance Down

Finance availability Up

Commercial

Supply chain costs Down

Performance risk Down

Customer service Up

Strategic

Investment risk Down

Cost of capital Down

Enterprise value Up