Welcome to SteelHedge

Digital economy redefines Sales and Operations Planning by streamlining and integrating previously siloed processes:

- Forward pricing without financial intermediation and derivatives;

- Optional conversion of pricing contracts into supply agreements;

- A global marketplace spanning primary and secondary value chains.

Together, we make ferrous markets more stable and sustainable.

How it feels

Direct

No middlemen

Bilateral transactions involve counterparties of your choosing that comply with criteria you define.

Now you may be in full control of S&O planning at low or no cost.

Simple

No derivatives

A modular contract tracks dozens products in many currencies throughout your supply chain.

Now you may reduce complexity to concentrate on core business.

Safe

No credit risk

When required, leading financial institutions ensure contractual settlements in any market situation.

Now you may choose several post-trade processing options.

Sustainable by design

A hybrid market grounded in real economy

Sustainable by design

A hybrid market grounded in real economy

How it works

How it works

Modular Contract

Settlement Options

Currencies

Pricing References

All steel grades and raw materials in one place

No need to use price indices in supply contracts

Modular Contract

Settlement Options

Currencies

Pricing References

All steel grades and raw materials in one place

No need to use price indices in supply contracts

Market price references in 12 currencies

All steel grades and raw materials in one place

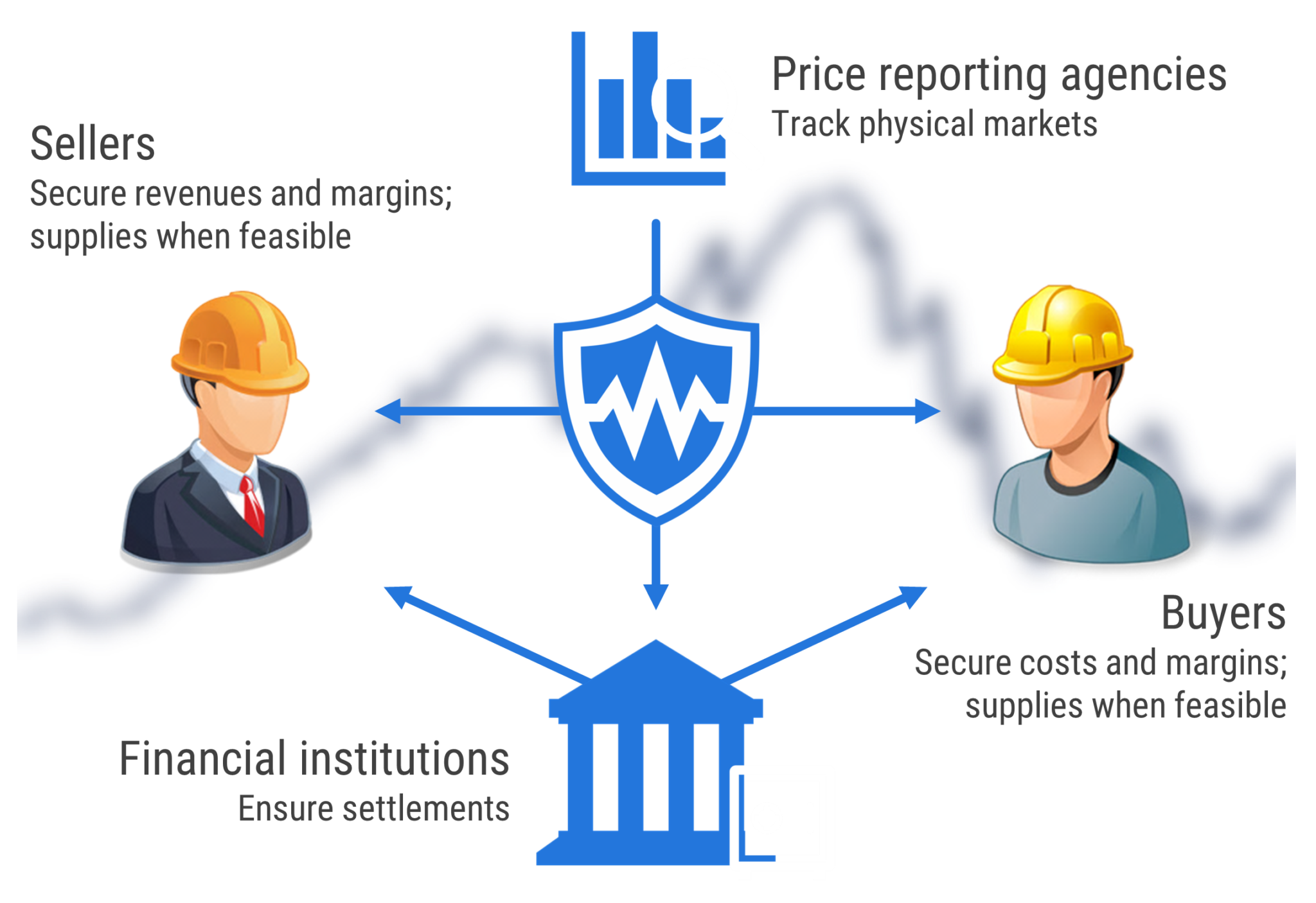

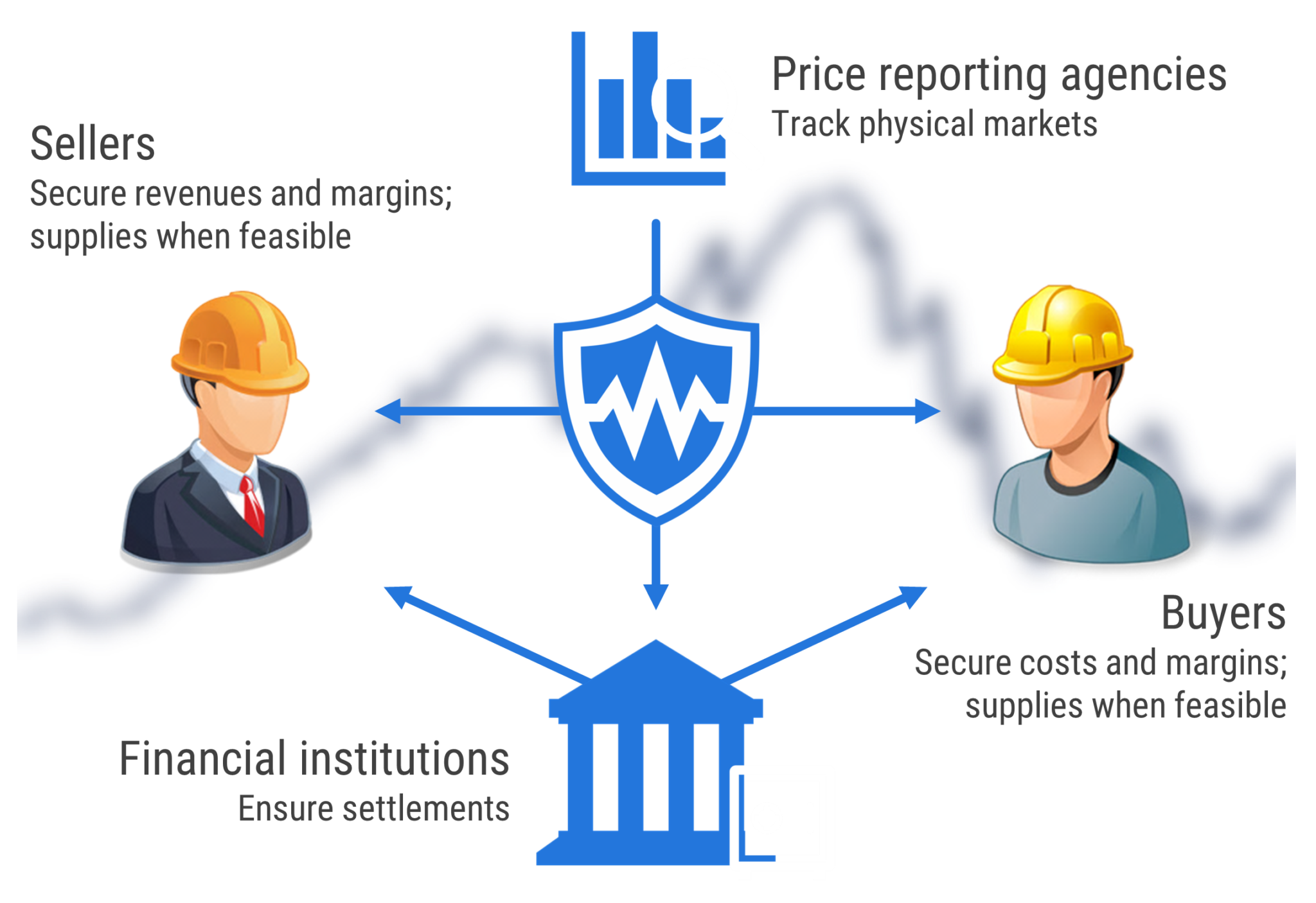

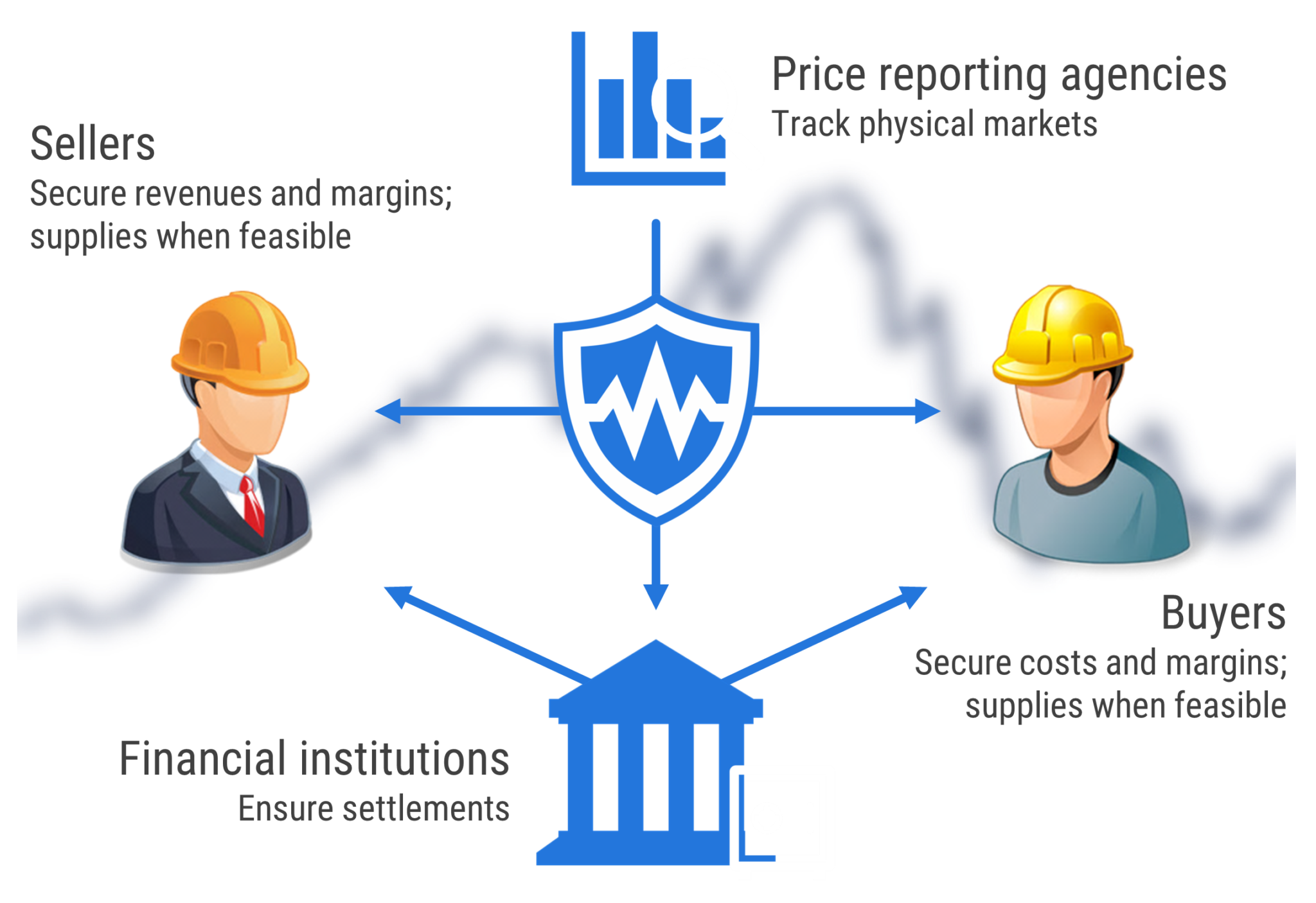

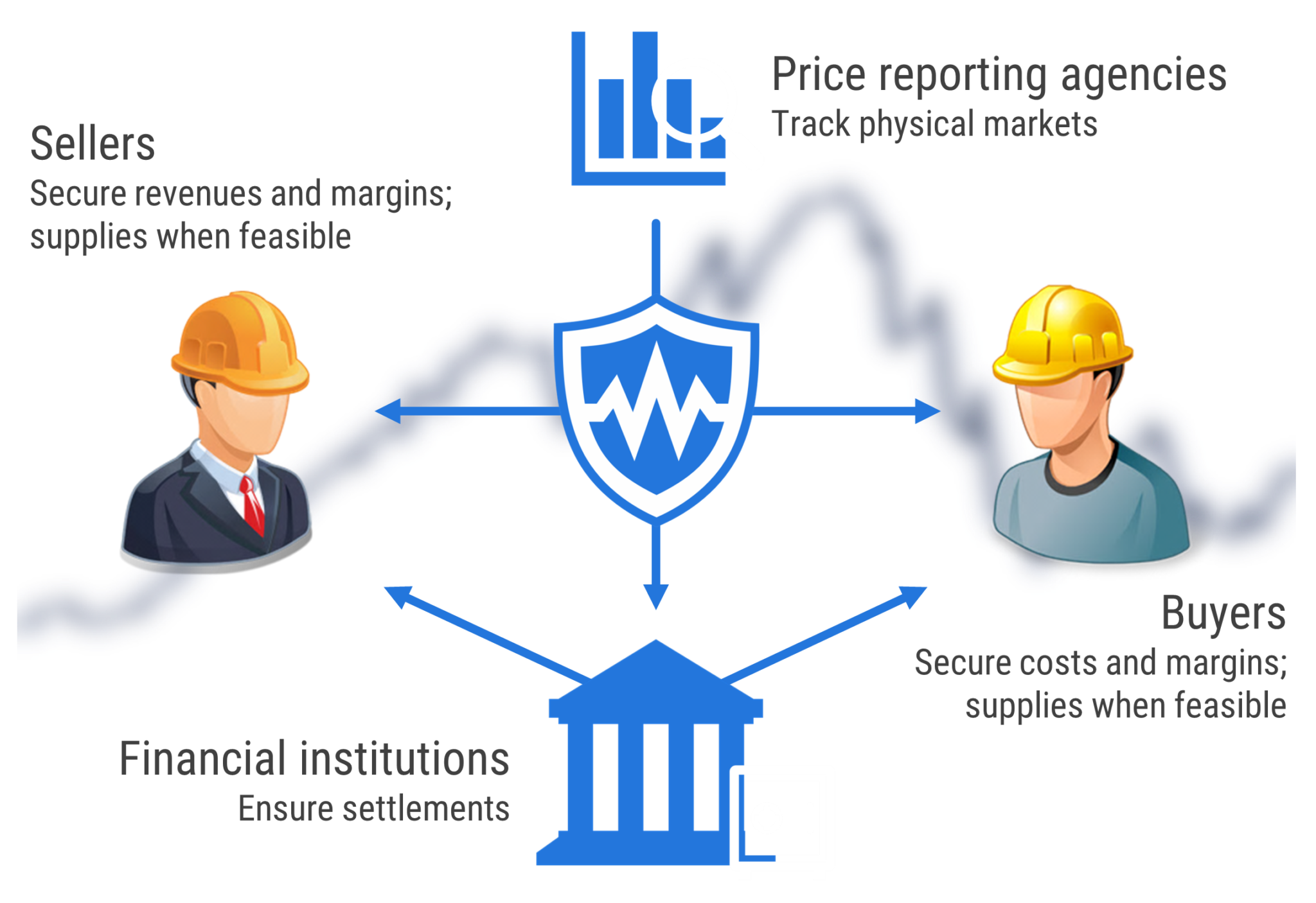

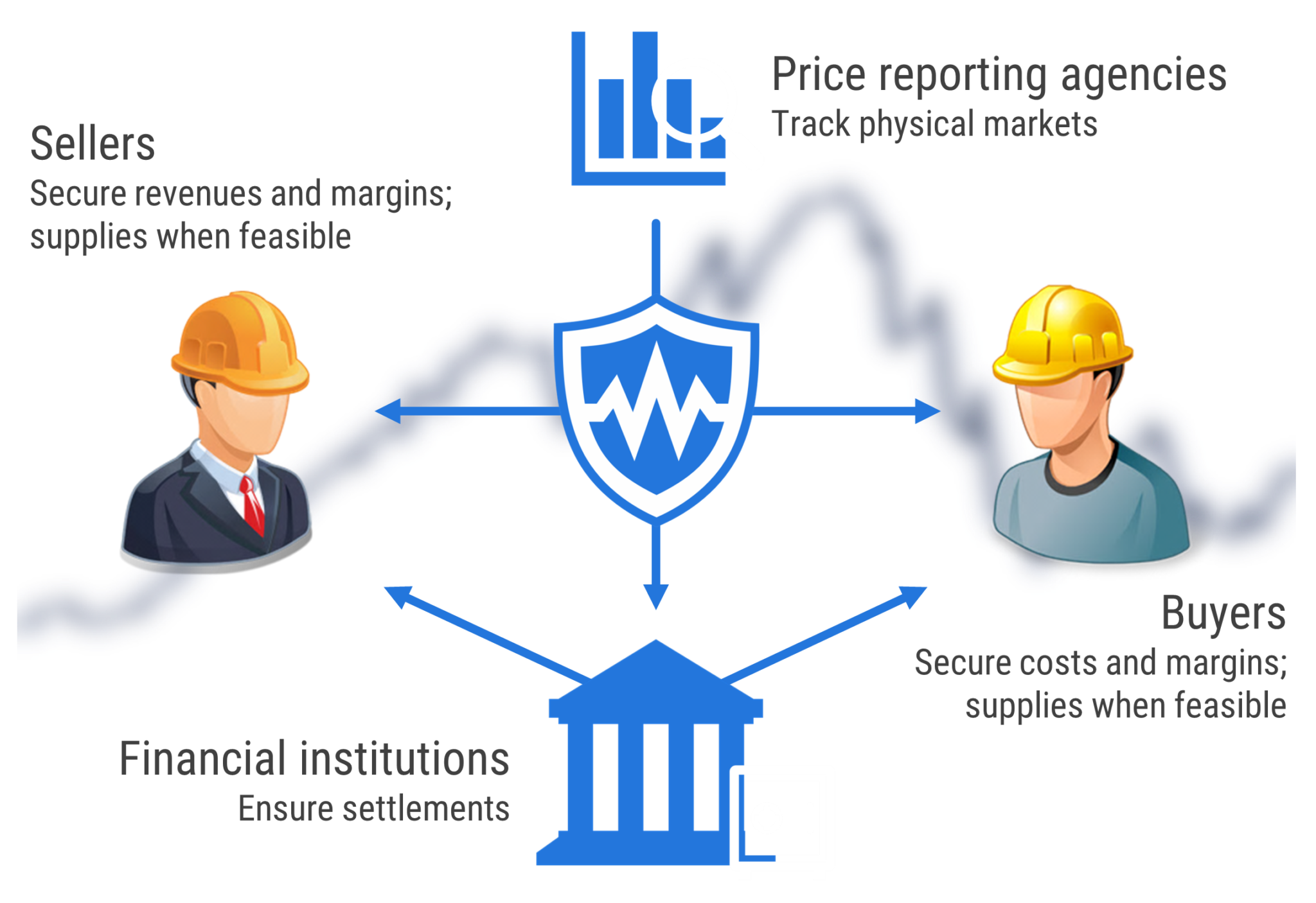

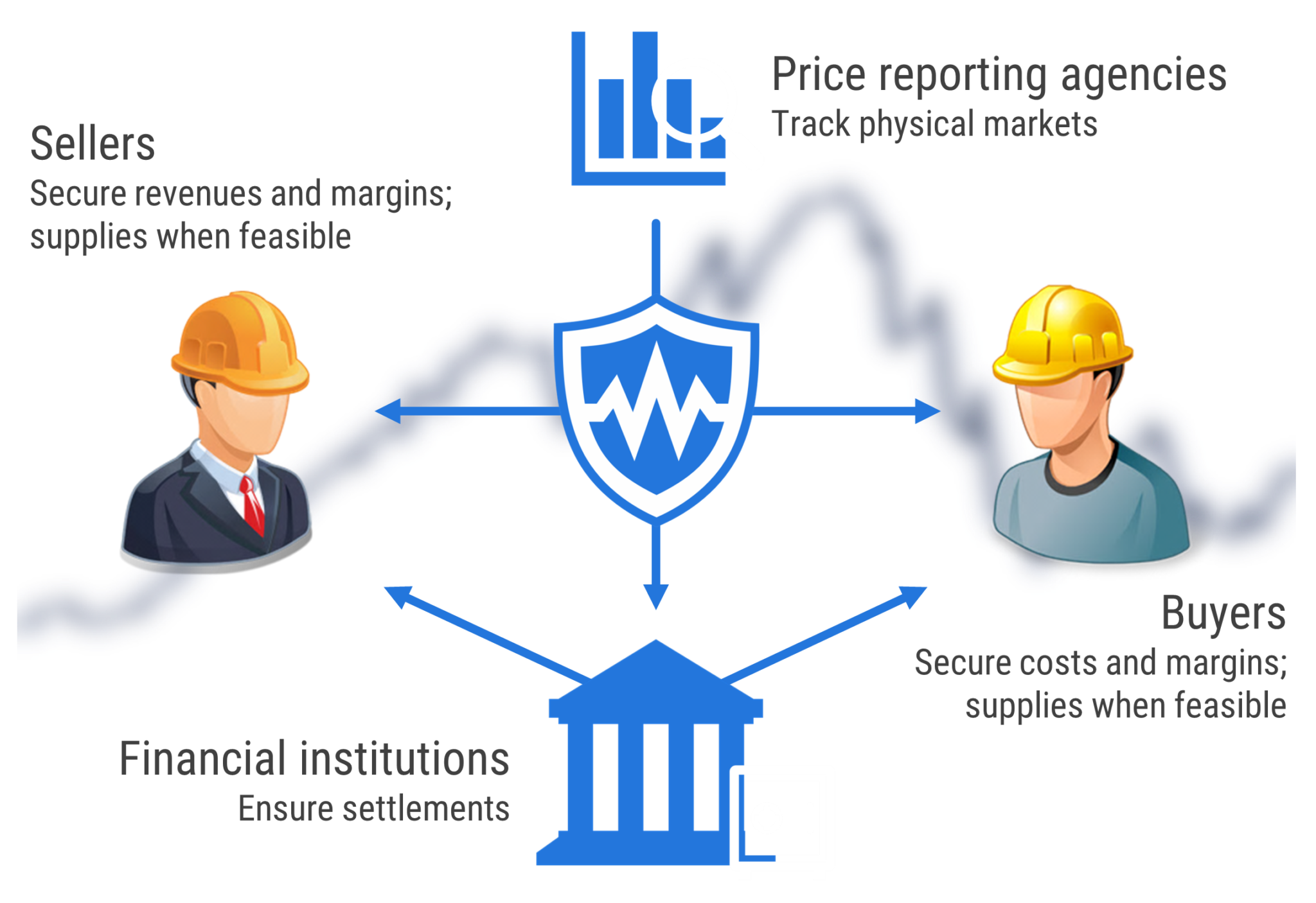

Ecosystem

Ecosystem

Markets change

You may drive change instead of being driven by it

Markets change

You may drive change instead of being driven by it

– Read Manifesto to understand our purpose

– Join Members Area to peruse our value proposition

– Save time with Live Demo

- Read Manifesto to understand our purpose

- Join Members Area to peruse our value proposition

- Save time with Live Demo